Renters Insurance in and around Whiteville

Your renters insurance search is over, Whiteville

Rent wisely with insurance from State Farm

Would you like to create a personalized renters quote?

There’s No Place Like Home

Home is home even if you are leasing it. And whether it's a condo or a townhome, protection for your personal belongings is a good precaution, even if your landlord doesn’t require it.

Your renters insurance search is over, Whiteville

Rent wisely with insurance from State Farm

Protect Your Home Sweet Rental Home

Many renters underestimate the cost of refurnishing a damaged property. Your valuables in your rented space include a wide variety of things like your guitar, couch, tablet, and more. That's why renters insurance can be such a good idea. But don't worry, State Farm agent Mary Jo Williamson has the experience and efficiency needed to help you understand your coverage options and help you keep your belongings protected.

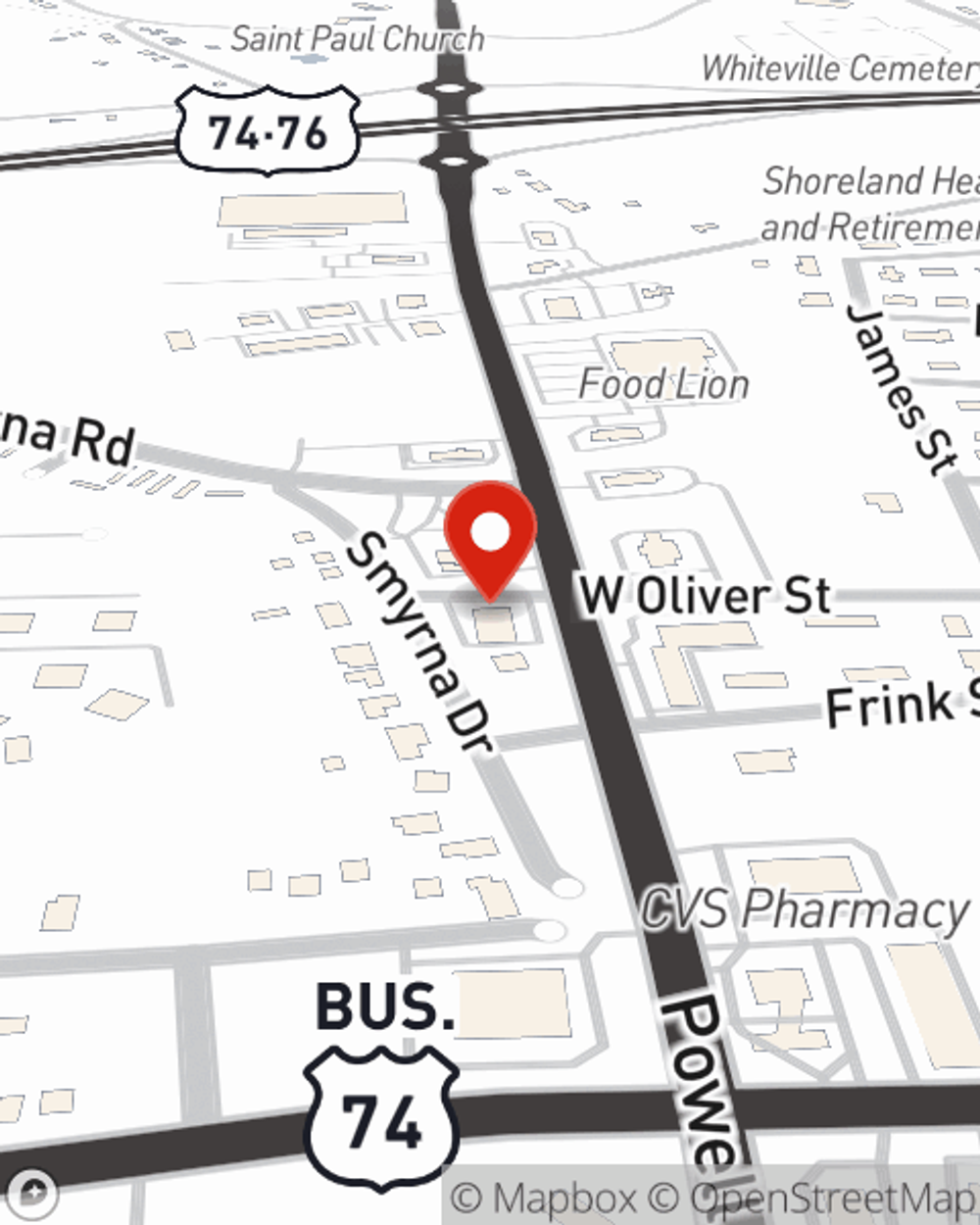

Renters of Whiteville, get in touch with Mary Jo Williamson's office to identify your personalized options and the advantages of State Farm renters insurance.

Have More Questions About Renters Insurance?

Call Mary Jo at (910) 642-3753 or visit our FAQ page.

Simple Insights®

How to create a home inventory

How to create a home inventory

A home inventory can be a way to help make home or renters insurance coverage decisions & expedite the insurance claims process after theft, damage or loss.

How to spot a roof leak and what to do if you have one

How to spot a roof leak and what to do if you have one

From mold on the roof to missing shingles, learn how to find roof leaks and know what to do.

Mary Jo Williamson

State Farm® Insurance AgentSimple Insights®

How to create a home inventory

How to create a home inventory

A home inventory can be a way to help make home or renters insurance coverage decisions & expedite the insurance claims process after theft, damage or loss.

How to spot a roof leak and what to do if you have one

How to spot a roof leak and what to do if you have one

From mold on the roof to missing shingles, learn how to find roof leaks and know what to do.